Weekly Recap : Crypto Rates W42

Market Overview

The digital asset complex underwent a substantial deleveraging event this period. Over $19 billion in open interest was liquidated across derivatives markets, resulting in a dramatic, market-wide reset of speculative positioning. While immediate momentum indicators confirm the sharp recoil from prior exuberance, underlying structural demand, evidenced by persistent ETF inflows and robust on-chain transaction volumes, remains resilient, suggesting the market is now entering a necessary consolidation phase.

Rates & Basis Analysis: Bitcoin and Ethereum

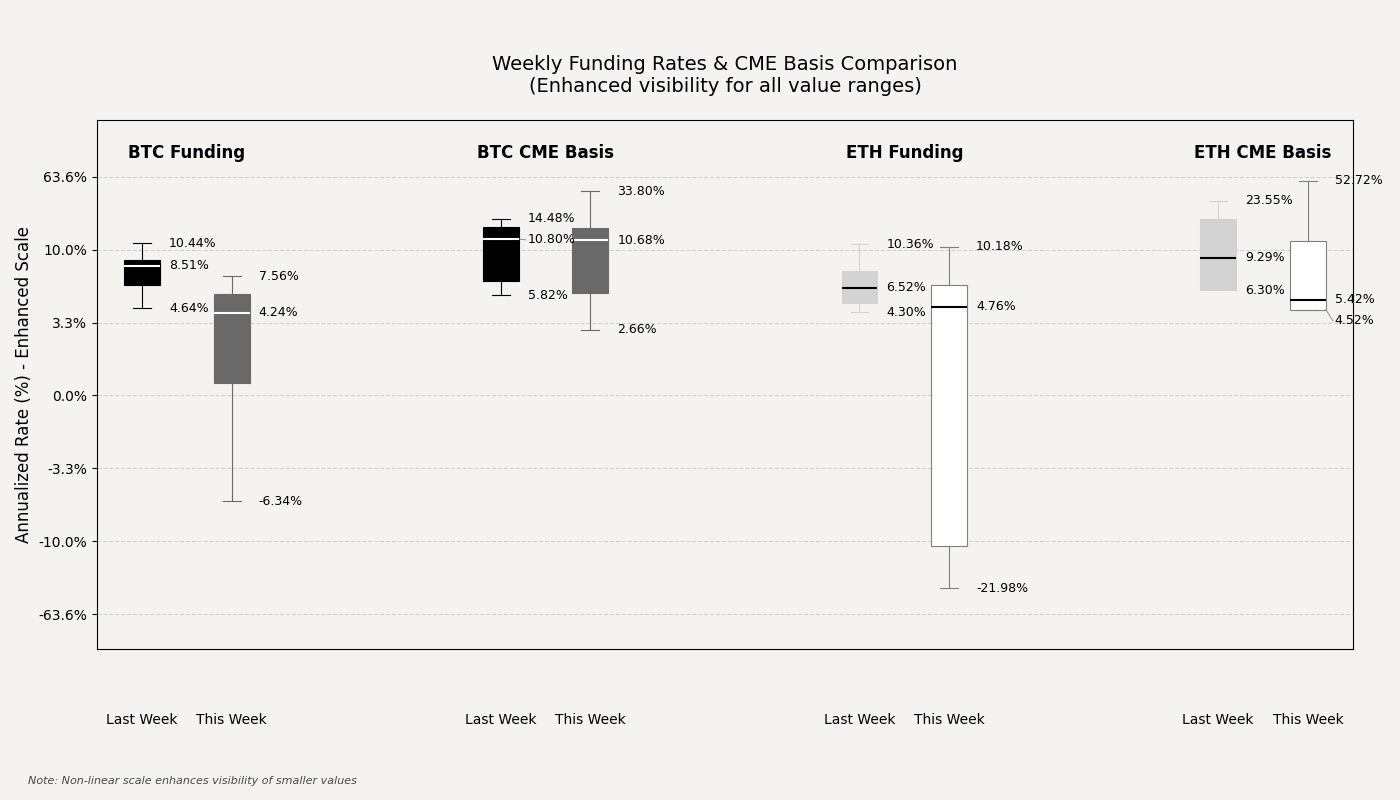

The derivatives funding landscape reflects the swift expulsion of leverage. This week, Centralized Exchange (CEX) perpetual funding rates for Bitcoin experienced a significant compression, with average annualized levels cooling to roughly 4.50% compared to the prior week's average of approximately 7.90%. This shift includes instances of negative funding, a directional reversal pointing to a purge of long-side exuberance. Similarly, Ethereum funding rates saw extreme volatility, with the weekly mean collapsing to near −1.70% from the previous 7.60% average, signaling a strong surge in short-side bias or intense delta hedging activity.

The forward term structure also bore the brunt of the volatility. The CME Bitcoin futures basis exhibited a dramatic dislocation, with daily annualized readings averaging approximately 14.60% this week, up sharply from 10.20% in the previous period. Notably, the weekly series was marked by a single, high-volatility outlier reading above 33%, which distorts the average but underscores periods of extreme premium and illiquidity in the regulated venue.

In contrast, the CME Ethereum basis experienced a pronounced collapse, averaging 15.10% this week compared to a previous average of 8.40%. However, this figure is also skewed by a significant outlier, as multiple daily data points for this week were deeply negative, suggesting periods of intense backwardation driven by sell-side hedging pressure in the regulated term contracts.

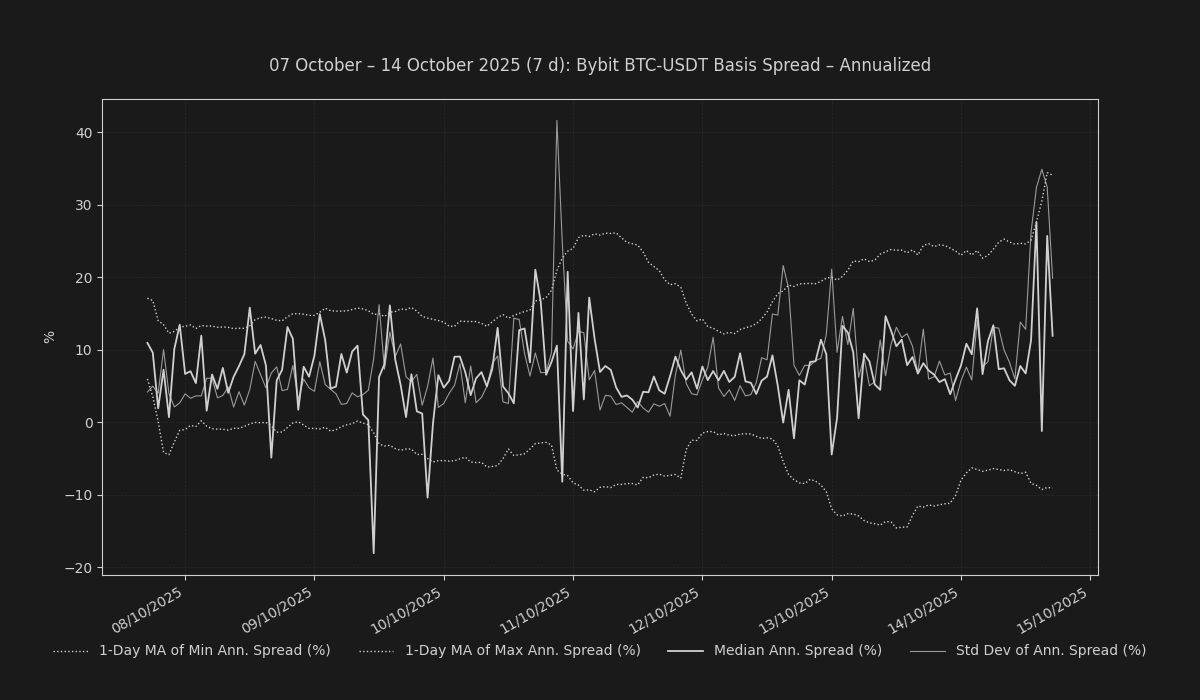

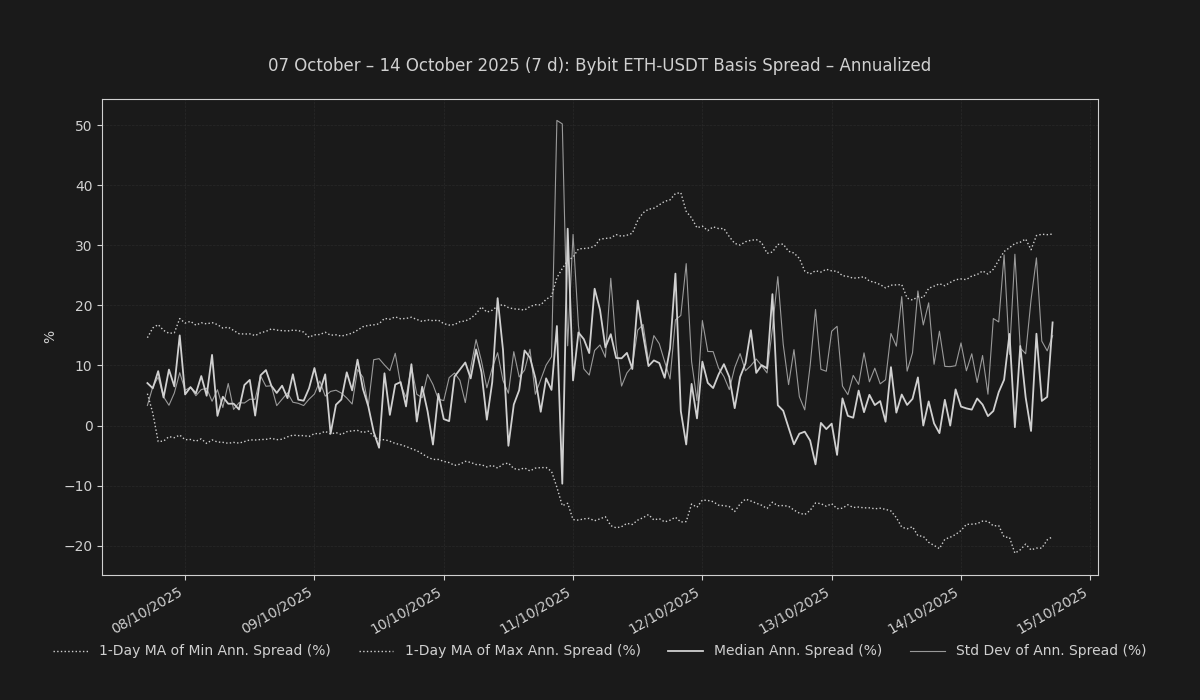

On the offshore side, the Bybit term basis for BTC closed the "Last 7 Days" period at 9.58%—a modest narrowing from 11.64% at the beginning of the period—indicating a slight convergence toward lower premiums. The Bybit ETH basis, conversely, showed greater stability in its premium, closing the period at a robust 17.16%. The divergence between the extreme daily volatility observed in the CME contracts and the relatively more stable closing prices in the offshore term structure (e.g., Bybit) suggests a segmentation in market participant behavior, with institutional and high-frequency traders potentially driving the immediate basis swings in CME.

Funding Arbitrage & Market Dislocations

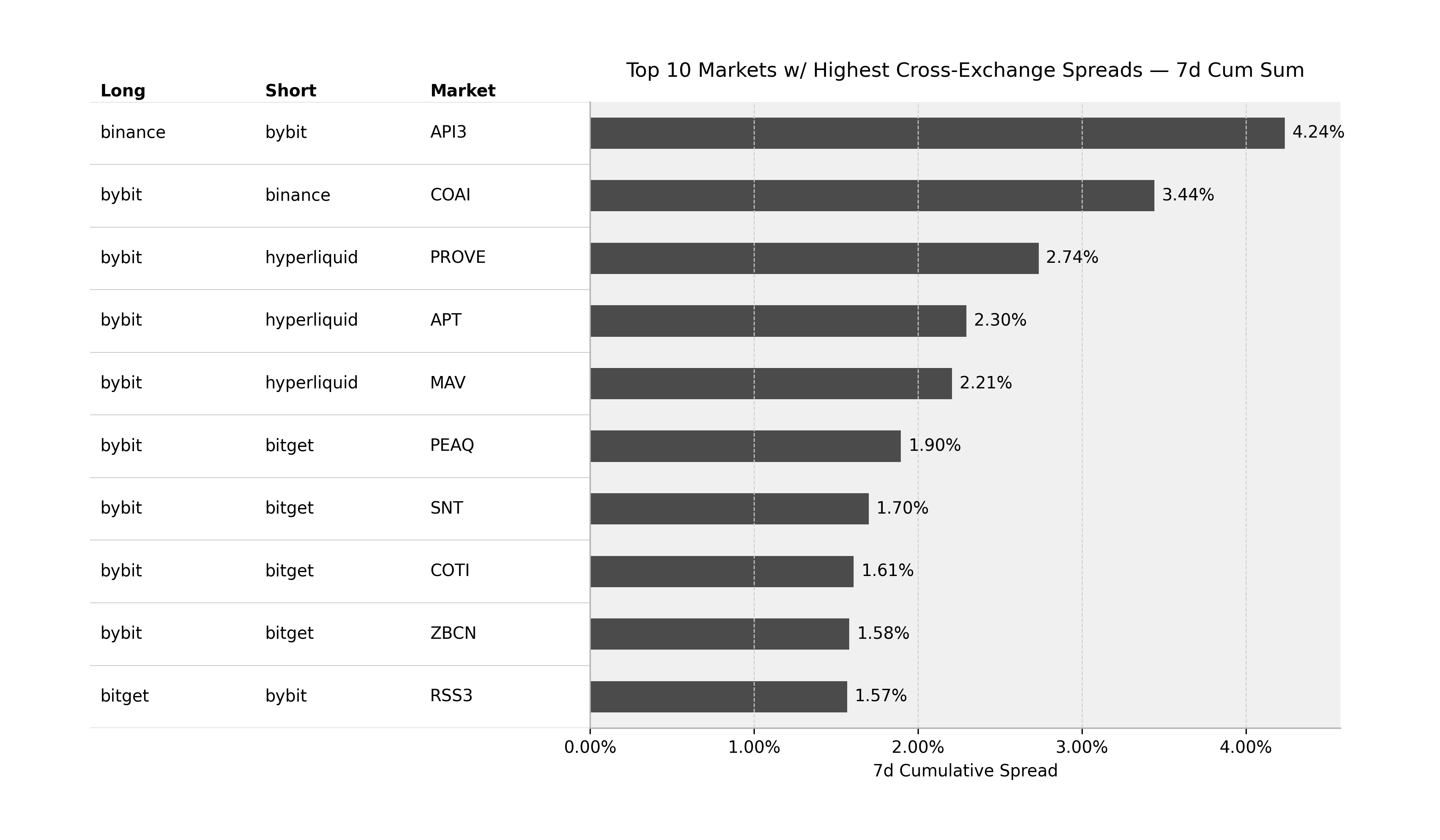

Structural cross-exchange inefficiencies persist, offering reliable carry for disciplined arbitrageurs. Over the last seven days, the most significant cumulative funding arbitrage opportunity was identified in API3, where a long position on Binance financed by a short on Bybit would have yielded a 4.24% raw cumulative spread. A secondary, notable dislocation was observed in the COAI market, where the inverse trade—short Binance, long Bybit—generated a 3.44% cumulative spread, underscoring idiosyncratic pricing across smaller-cap assets.

Altcoin Funding Dynamics

Altcoin funding rates reflect a heterogeneous but largely bearish shift in sentiment post-deleveraging. TRX funding on Binance saw a notable deterioration, with the 8-hour cumulative funding rate moving from a marginally positive aggregate in the previous week to a markedly negative −0.00026% this period, suggesting a material increase in short interest or hedging. Conversely, LINK funding on Bybit demonstrated comparative resilience, with its 8-hour cumulative rate remaining firmly positive at the 0.0001% exchange floor, suggesting continued long interest or robust illiquidity in the derivative contract.

Conclusion

The pervasive cooling of perpetual funding rates, coupled with the extreme dislocations observed in the forward basis, definitively confirms a liquidation-driven cleaning of excess leverage. While the carry trade has become significantly less favorable for long positions in the immediate term, the reduction in speculative froth establishes a healthier foundation for price discovery. We anticipate a period of rates consolidation as dealers seek to re-establish stable positioning, awaiting renewed directional impetus.