Weekly Recap : Crypto Rates W44

Market Overview

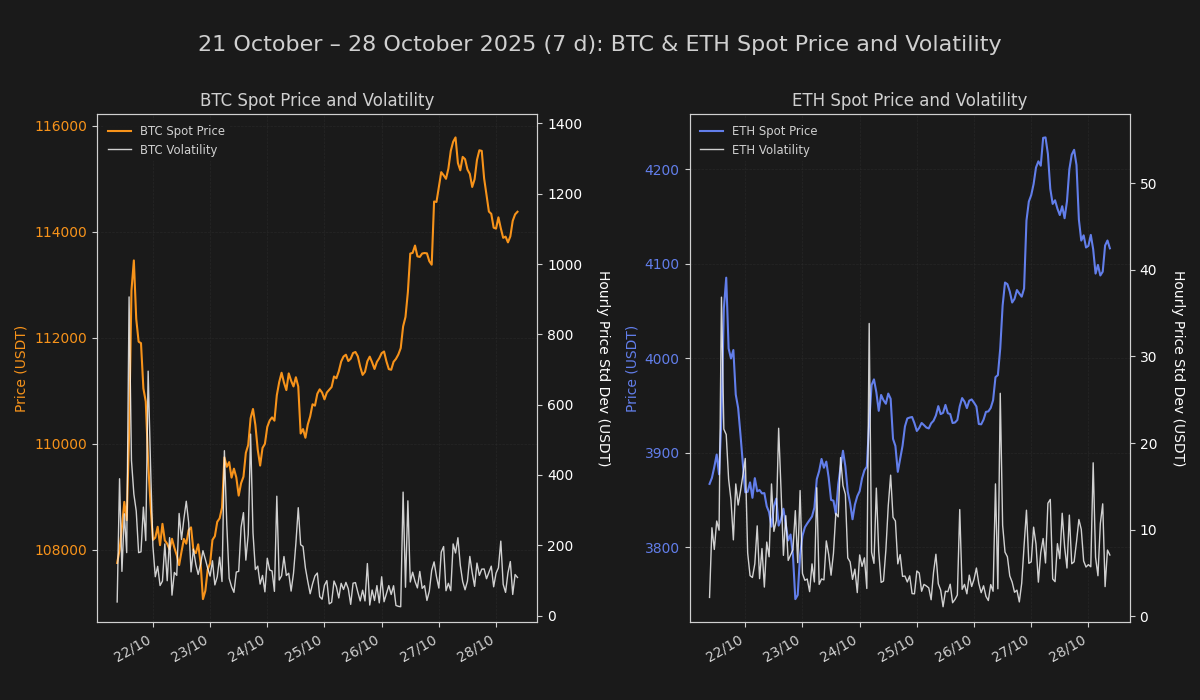

The digital asset market exhibited clear signs of stabilization this past week, arresting the prior period's downward momentum. A technical rebound in primary assets was met with moderate, albeit not aggressive, participation. The current price action suggests a consolidation phase may be underway as market participants reassess directional conviction following the recent reset in leverage and positioning.

Rates & Basis Analysis: Bitcoin and Ethereum

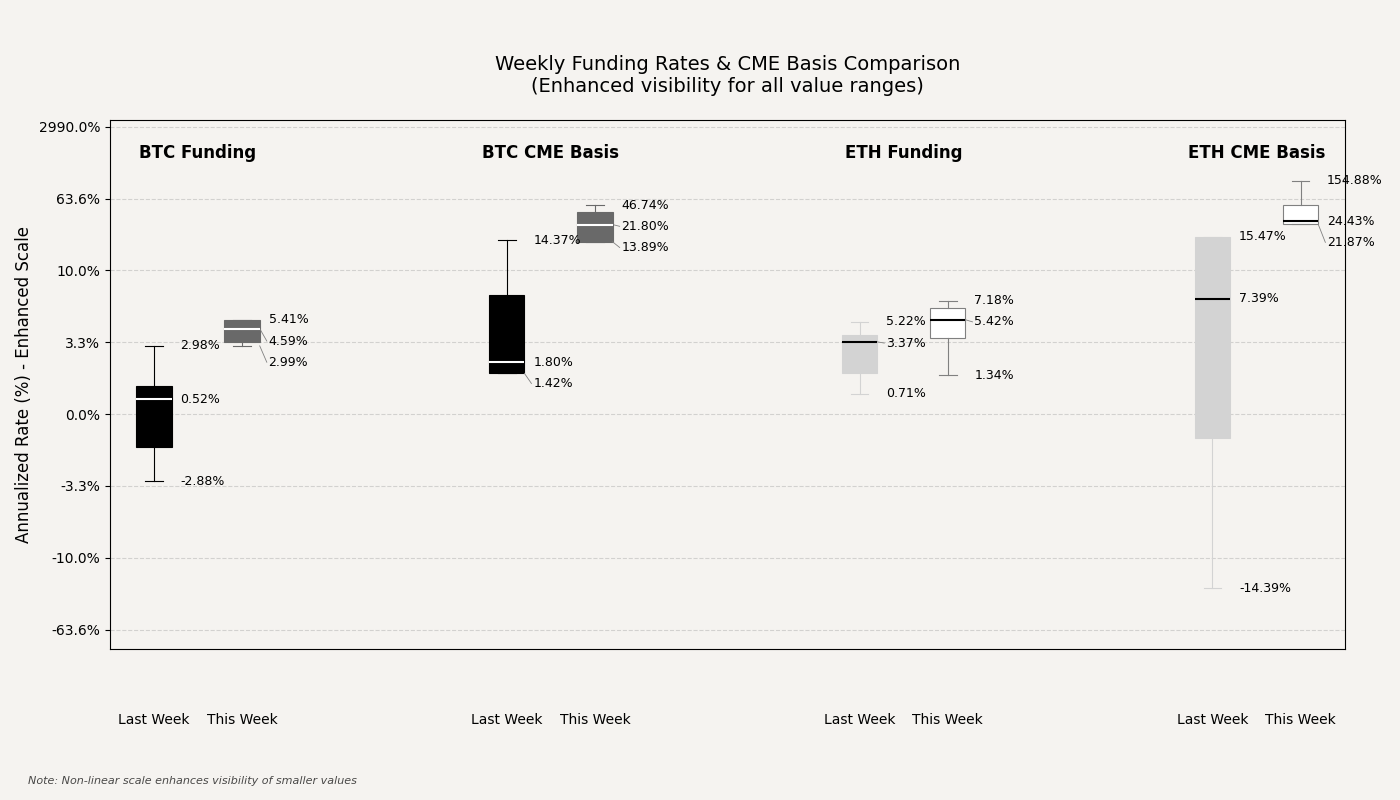

A significant shift occurred in the cost of leverage for major assets, signaling a revival of bullish sentiment. Bitcoin perpetual funding rates, which had been oscillating around neutral territory, firmed considerably. The average daily annualized rate climbed to approximately 4.6%, a stark contrast to the near-zero average of the prior week. This indicates that long-side demand has returned, requiring perpetual holders to pay a consistent premium. Ethereum funding rates followed a similar, though less aggressive, trajectory, with the average rate tightening to roughly 4.9% from the previous period's 2.6%.

The forward term structure, a key barometer of institutional sentiment, showed even more pronounced strength. The basis on CME Bitcoin futures expanded dramatically, with the average annualized premium widening to over 21% from less than 3% in the preceding week. This powerful move reflects renewed demand for longer-dated, regulated long exposure. The CME Ethereum basis experienced an even more explosive repricing, vaulting to an average premium near 49%, driven by several days of exceptionally strong demand that points toward aggressive positioning or hedging activity in the regulated venue.

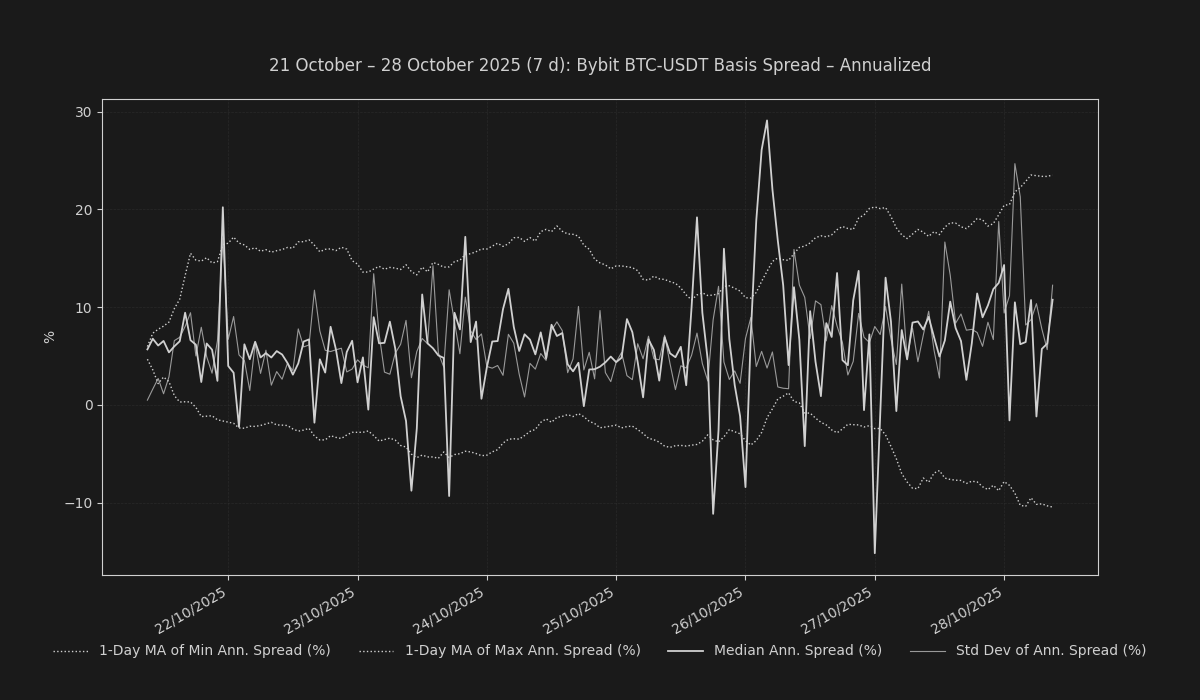

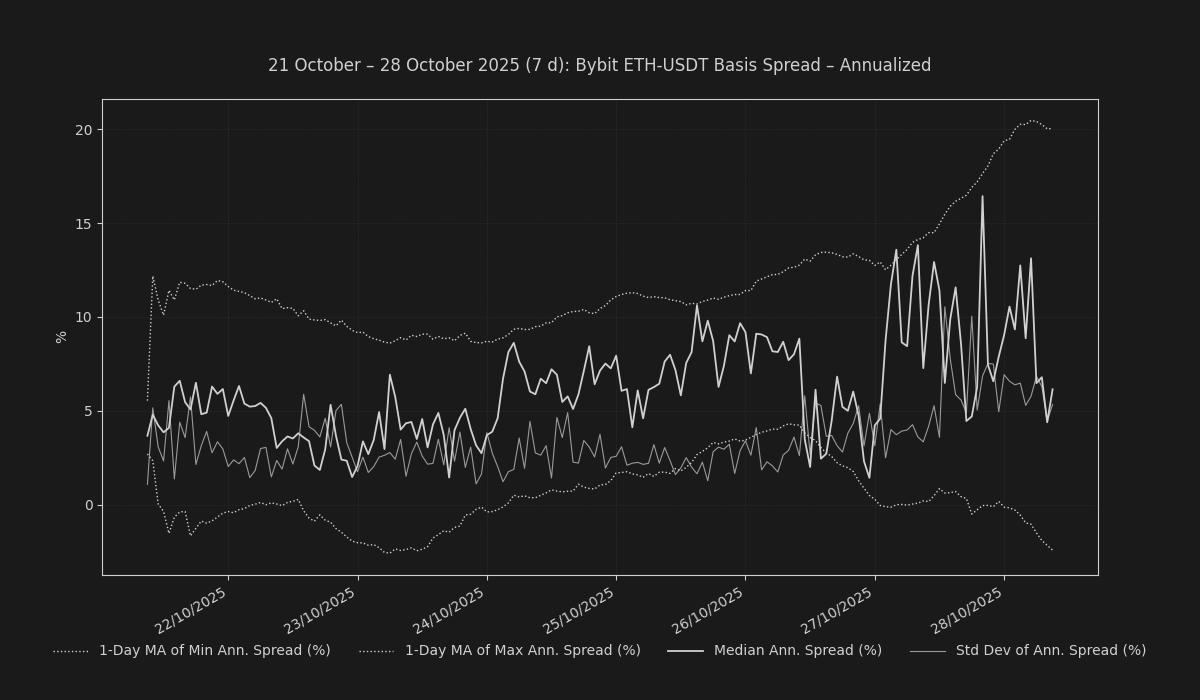

This renewed optimism was mirrored in the offshore term structure. The three-month annualized basis for Bitcoin on major derivatives exchanges closed the period at a healthy premium of approximately 24.5%. Ethereum's forward curve showed a more modest, yet still positive, recovery, with its comparable basis settling around 4.5%, lagging Bitcoin's premium expansion.

Funding Arbitrage & Market Dislocations

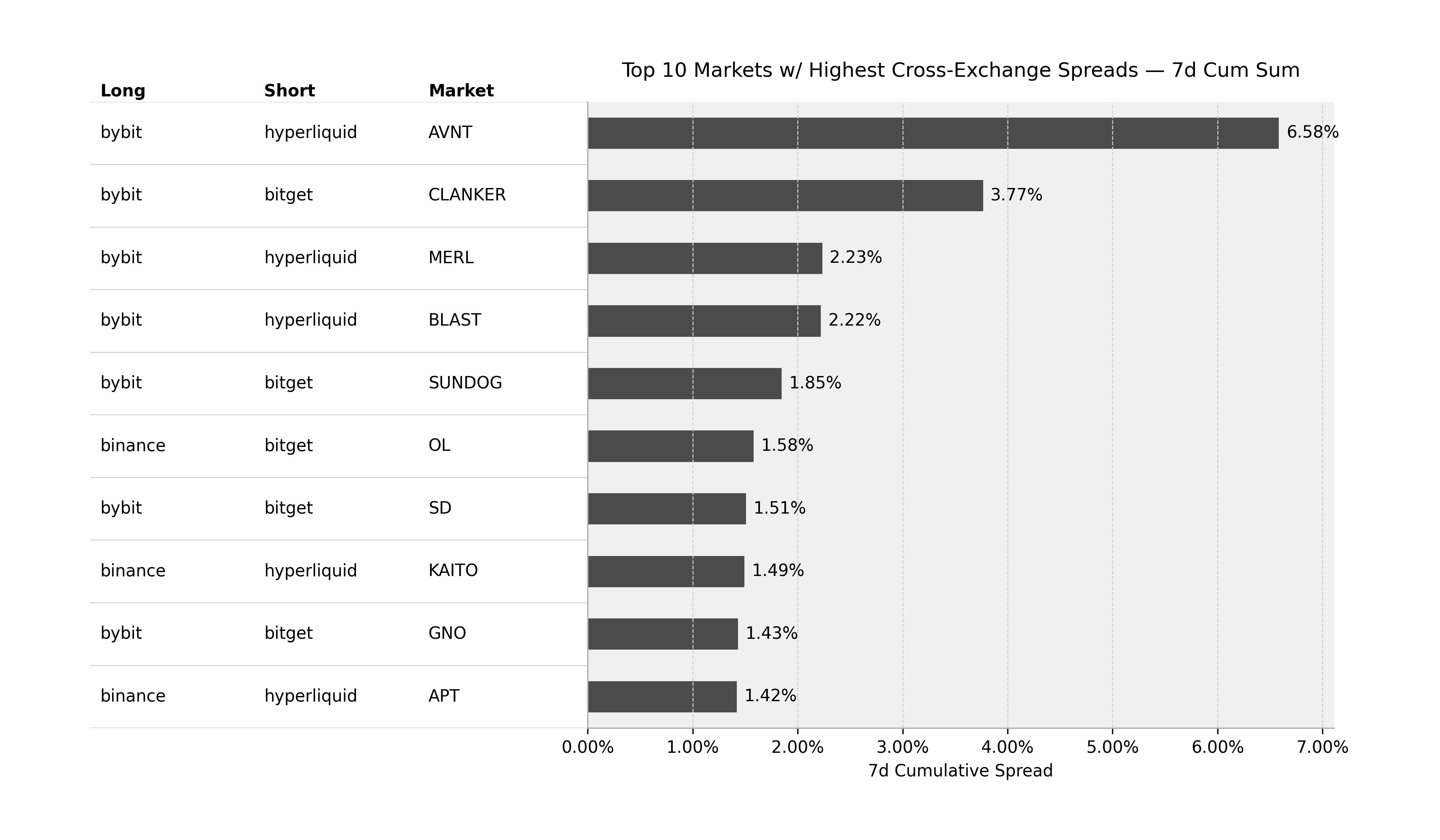

Despite the broad repricing higher in funding, significant dislocations between venues continue to present opportunities for rates arbitrageurs. The most notable spread was observed in the AVNT market, where a long position on Bybit financed by a short on Hyperliquid generated a 7-day cumulative raw spread of approximately 0.066. Another compelling opportunity arose in the CLANKER market, which offered a cumulative spread of roughly 0.038 for a long Bybit versus short Bitget position, underscoring persistent pockets of inefficiency.

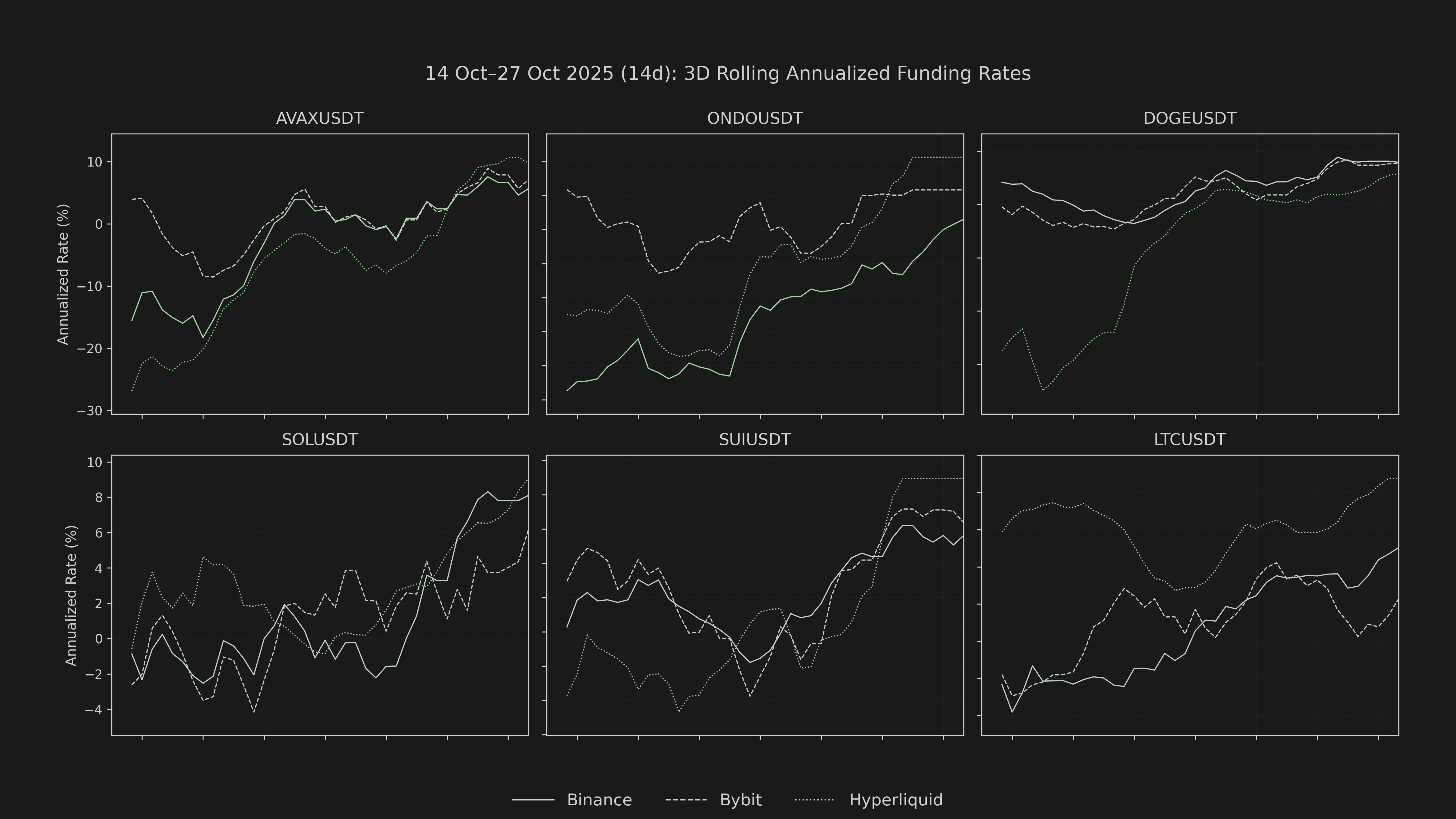

Altcoin Funding Dynamics

Within the altcoin complex, sentiment shifts were equally evident. Funding for CRV on Binance, for instance, reversed sharply from a cumulative 8-hour close of approximately -0.00012 in the prior period to a firmly positive 0.0001 this week, indicating a significant abatement of short-side pressure. Similarly, ONDO funding flipped from negative to positive territory, suggesting a constructive rotation of speculative interest into the asset.

Conclusion

The market's decisive deleveraging is unequivocally reflected in the sharp compression of CEX perpetual funding rates and the material narrowing and occasional backwardation of the futures basis across both regulated and offshore venues. The current rates environment significantly diminishes the appeal of the long-side carry trade and points to a period where dealer books are relatively cleaner but positioned defensively, awaiting a fundamental catalyst to re-engage directional risk.