Weekly Recap : Crypto Rates W32

Market Overview

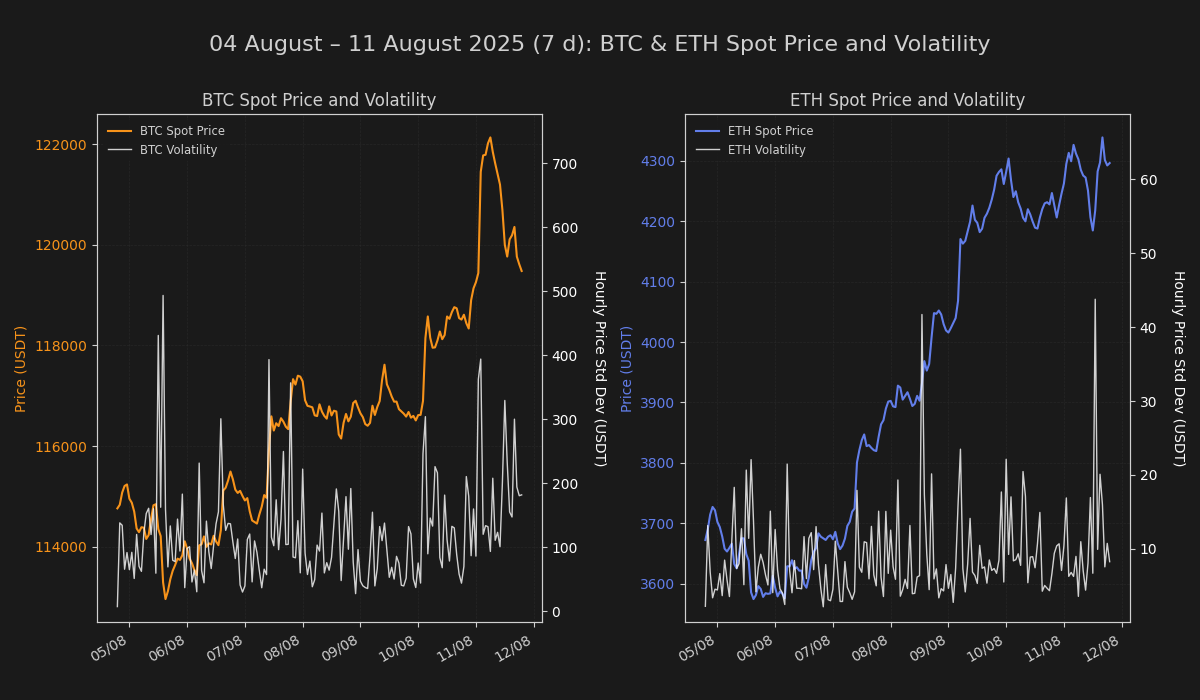

Digital assets advanced on the week, with Bitcoin recovering decisively from last week’s pullback to trade back near recent highs. Price action was accompanied by modest improvements in market breadth, though turnover failed to keep pace, underscoring a rebound driven more by positioning adjustments than sustained spot demand. Broader sentiment firmed, but elevated profit-taking risk remains embedded in the structure.

Rates & Basis Analysis: Bitcoin and Ethereum

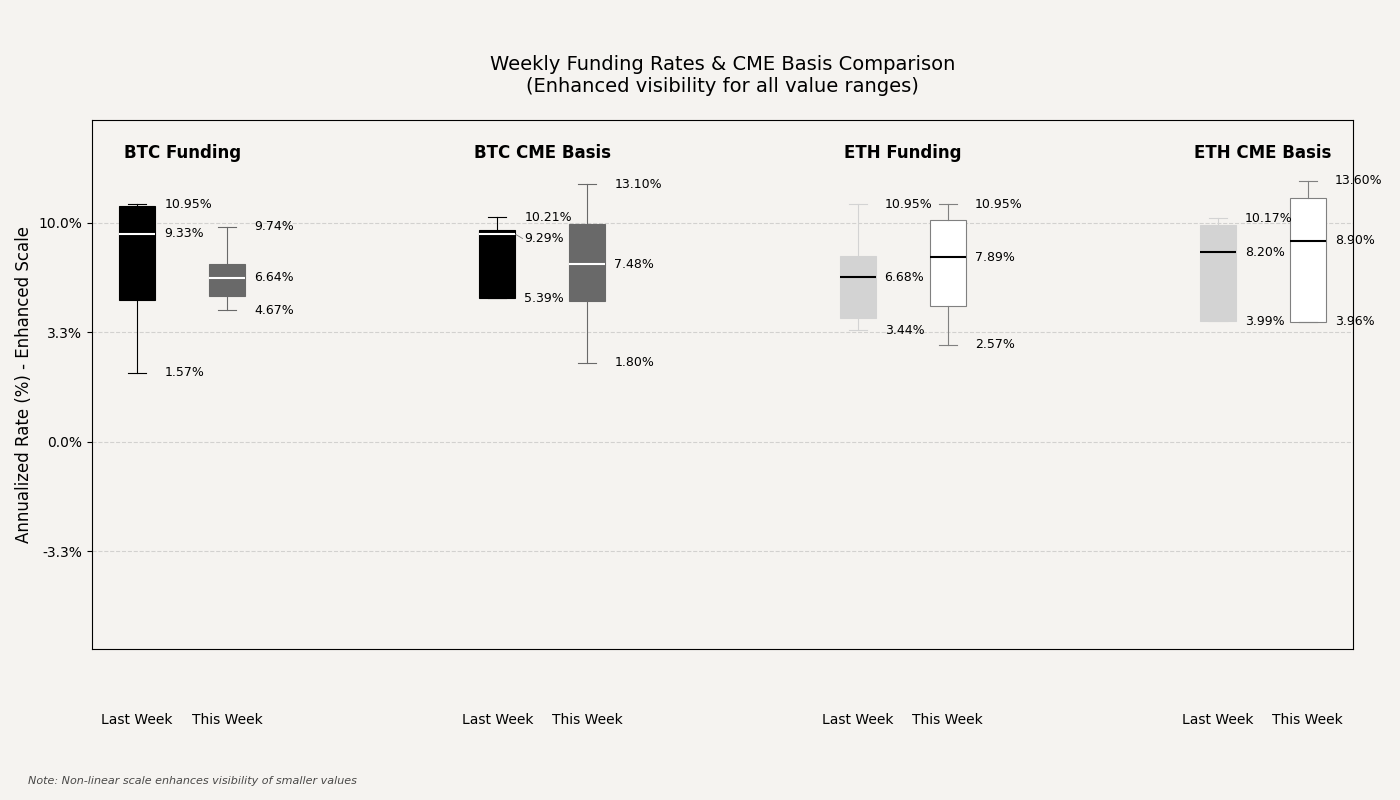

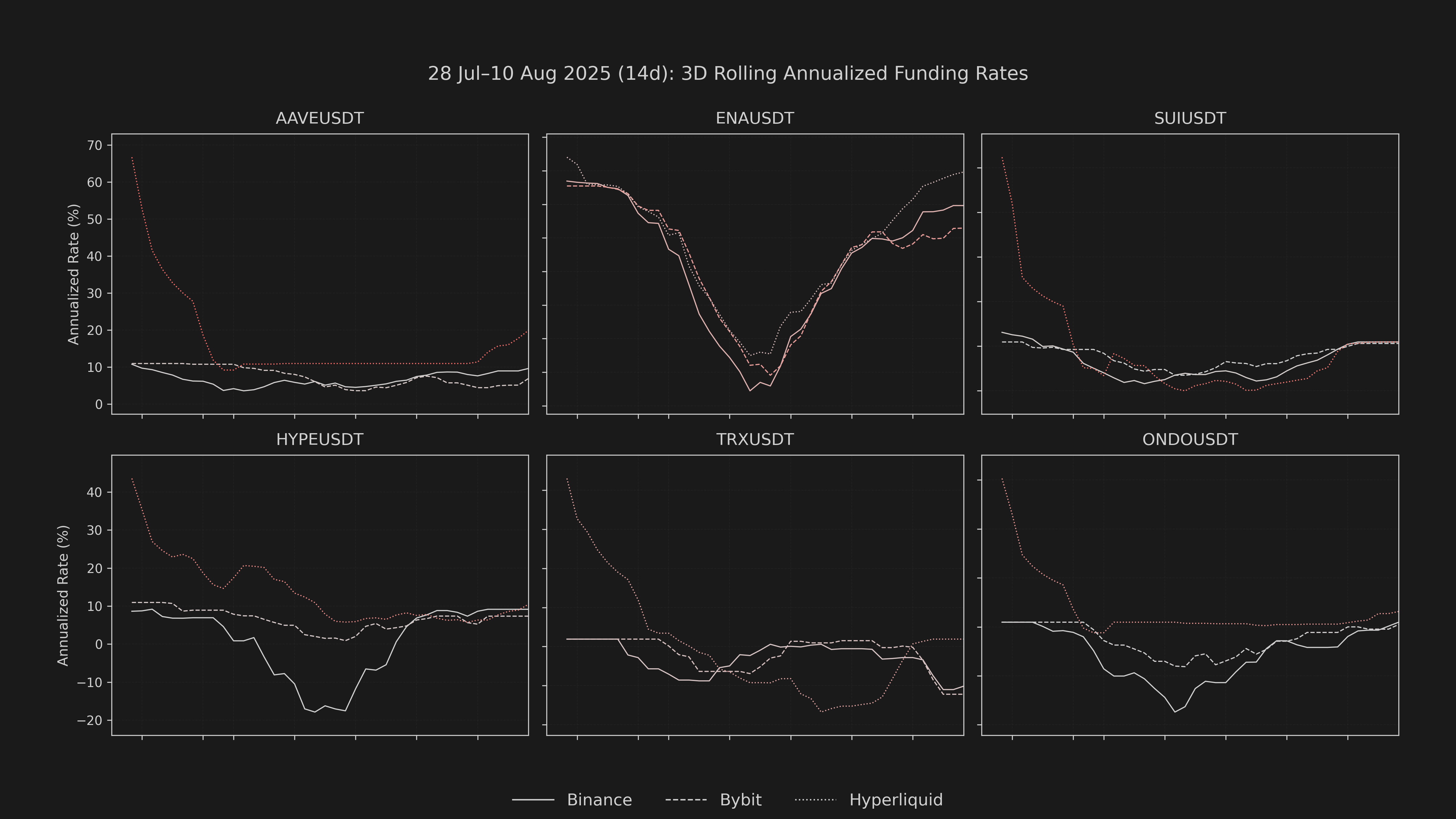

Perpetual funding costs moderated across majors, signaling a cooling in leverage appetite. Bitcoin’s average annualized funding fell sharply from persistent double-digit prints near 10.9% last week to roughly 6–7% this week, with intraday readings showing reduced dispersion. Ethereum’s retracement was even more pronounced, sliding from ~10.9% to near 5%, marking a broad normalization in long carry and a clear shift away from the aggressive long bias seen earlier in the month.

CME term structure likewise softened. Bitcoin’s basis narrowed materially, averaging closer to mid-single digits versus last week’s near-double-digit carry, with several sessions dipping toward low positive territory. Ethereum’s CME curve exhibited a comparable easing, moving from a strong premium last week into levels consistent with reduced institutional risk exposure. This flattening suggests a paring of directional bets and a more defensive tenor in regulated markets.

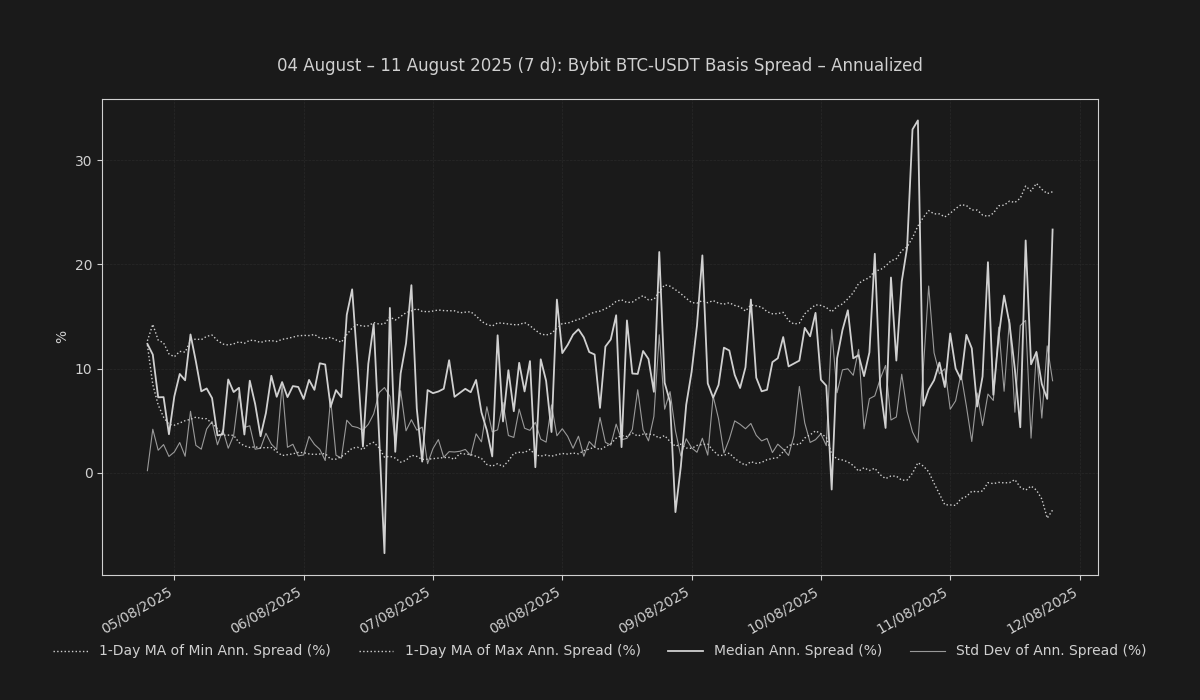

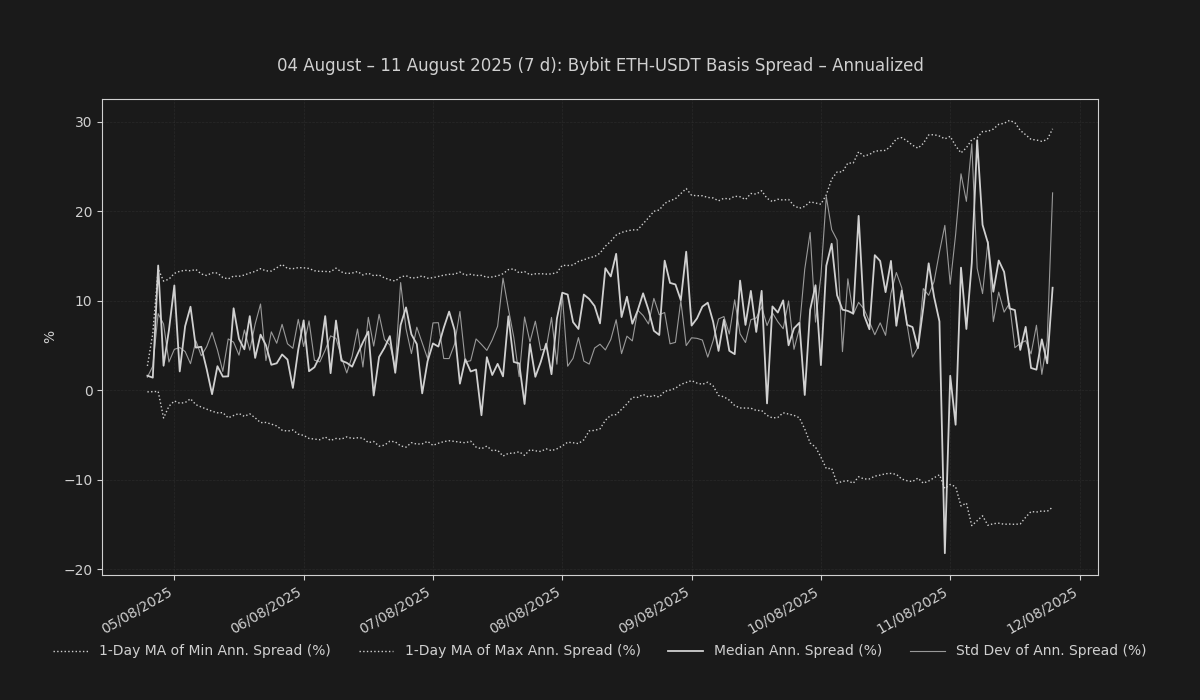

Offshore futures curves on Bybit told a slightly different story. The annualized close on Bitcoin-USDT basis surged to an elevated ~40.85% from the prior week’s absent or muted reading, reflecting a late-week uptick in speculative forward demand. Ethereum’s equivalent basis closed even higher at ~60.09%, a notable premium despite earlier week softness—indicative of sudden, concentrated positioning flows. The sharp end-of-week expansion contrasts with the compression seen in funding, highlighting that outright demand for dated forwards remains sporadically strong, even as perpetual traders de-risk.

Funding Arbitrage & Market Dislocations

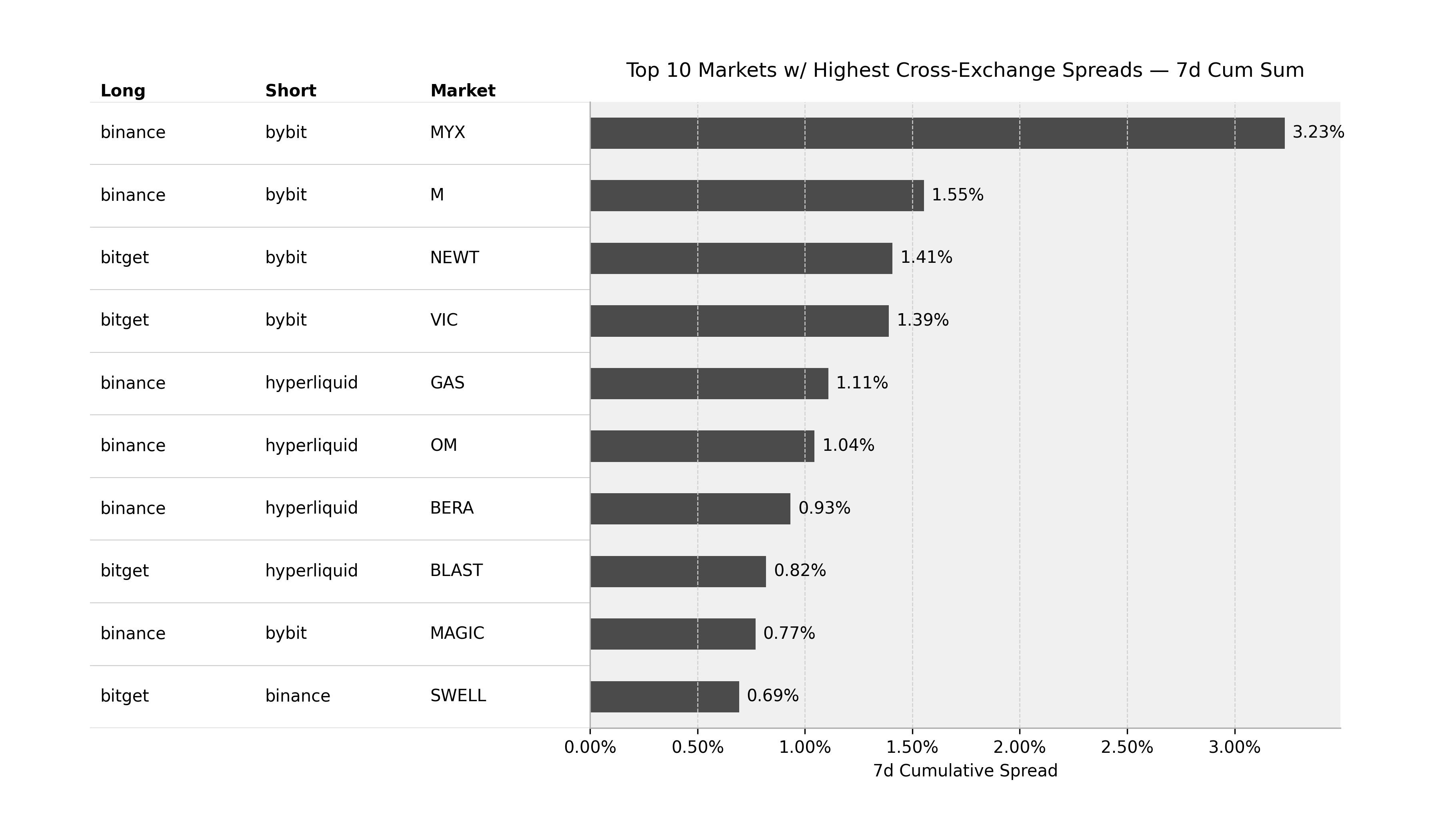

Select cross-exchange differentials remained compelling for tactical basis capture. The most pronounced dislocation was observed in MYXUSDT, where maintaining a long on Binance against a short on Bybit would have harvested approximately 3.49% over the week. PROVEUSDT also offered attractive carry, with a Binance long versus Hyperliquid short yielding ~1.75%. These spreads indicate that while aggregate funding pressure has moderated, localized liquidity skews and venue-specific positioning continue to generate meaningful arbitrage windows.

Altcoin Funding Dynamics

The altcoin complex displayed several notable shifts in cumulative 8-hour funding. ENAUSDT funding turned decisively more negative across venues—on Binance sliding from near-flat to -0.00088, and on Hyperliquid from -0.00022 to -0.00082—signaling a deepening of short-side conviction. SEIUSDT on Binance swung from a marginally positive close of 0.000003 to +0.000037, while Hyperliquid’s SEI moved from neutral to -0.00023, reflecting fragmented sentiment and venue-specific directional skew. These divergent patterns point to persistent idiosyncratic flows within the altcoin space, often decoupled from broader market tone.

Conclusion

The rates landscape this week reflects a recalibration from prior overheated conditions—funding compressing materially, CME curves flattening, yet pockets of extreme basis and cross-venue dislocations persisting. The blend of subdued perpetual carry with episodic forward premium suggests that while the market is less crowded on the long side, selective opportunities remain for nimble basis and funding arbitrage strategies in an environment still prone to sharp sentiment pivots.